Corporate travel risk management (TRM) has long been seen as a moral and legal imperative, but today, it’s becoming a financial strategy too. Insurers are beginning to explore premium discounts for companies that proactively demonstrate strong duty of care, especially those aligned with ISO 31030 standards. And the key to proving it? Complete, real-time travel data.

Let’s unpack why this matters and how your company can turn risk management into a cost-saving advantage.

Insurers Are Paying Attention to Travel Risk Management

The days of viewing business travel insurance as a simple transactional necessity are numbered. Insurance providers like AXA Partners, International SOS, and Hiscox are increasingly interested in how companies manage risk before it escalates to a claim. In fact, AXA is actively evaluating whether to offer discounts on insured products for companies that can demonstrate ISO 31030 compliance and ideally, go beyond it.

Shaun Boulter, AXA Partners' global head of operations and security, put it plainly: “There’s less potential for any possible claim… or there’s more of a possibility of it being an easier-to-handle incident” when clients are actively managing risk.

That kind of clarity doesn’t just make incidents more manageable — it could translate into reduced premium spend across broader insurance categories.

ISO 31030 and the Need to Prove Risk Control

ISO 31030, the international standard for travel risk management, provides a detailed framework for assessing and mitigating risks to travelers. But compliance with the standard isn’t just about having the right intentions — it’s about demonstrating consistent, measurable, and auditable practices.

This is where the insurance industry’s interest in data comes into sharp focus.

According to risk management experts, the number one thing insurers need to justify discounts is data: Does having a TRM program actually reduce the number and severity of claims? That’s not something that can be proved with a policy document or an internal protocol checklist. It requires a complete picture of how travel risk is managed in practice, which starts with knowing where your travelers are going, how they got there, and what they’re exposed to.

The Role of Complete Travel Data in Risk Validation

Unfortunately, for most organizations, traditional travel data sources fall short. Bookings made outside of approved channels (direct with suppliers, through OTAs, etc.) often go undetected, leaving risk management teams unaware of who’s traveling, where they are, or what itineraries may be impacted during a crisis.

That’s where Traxo comes in.

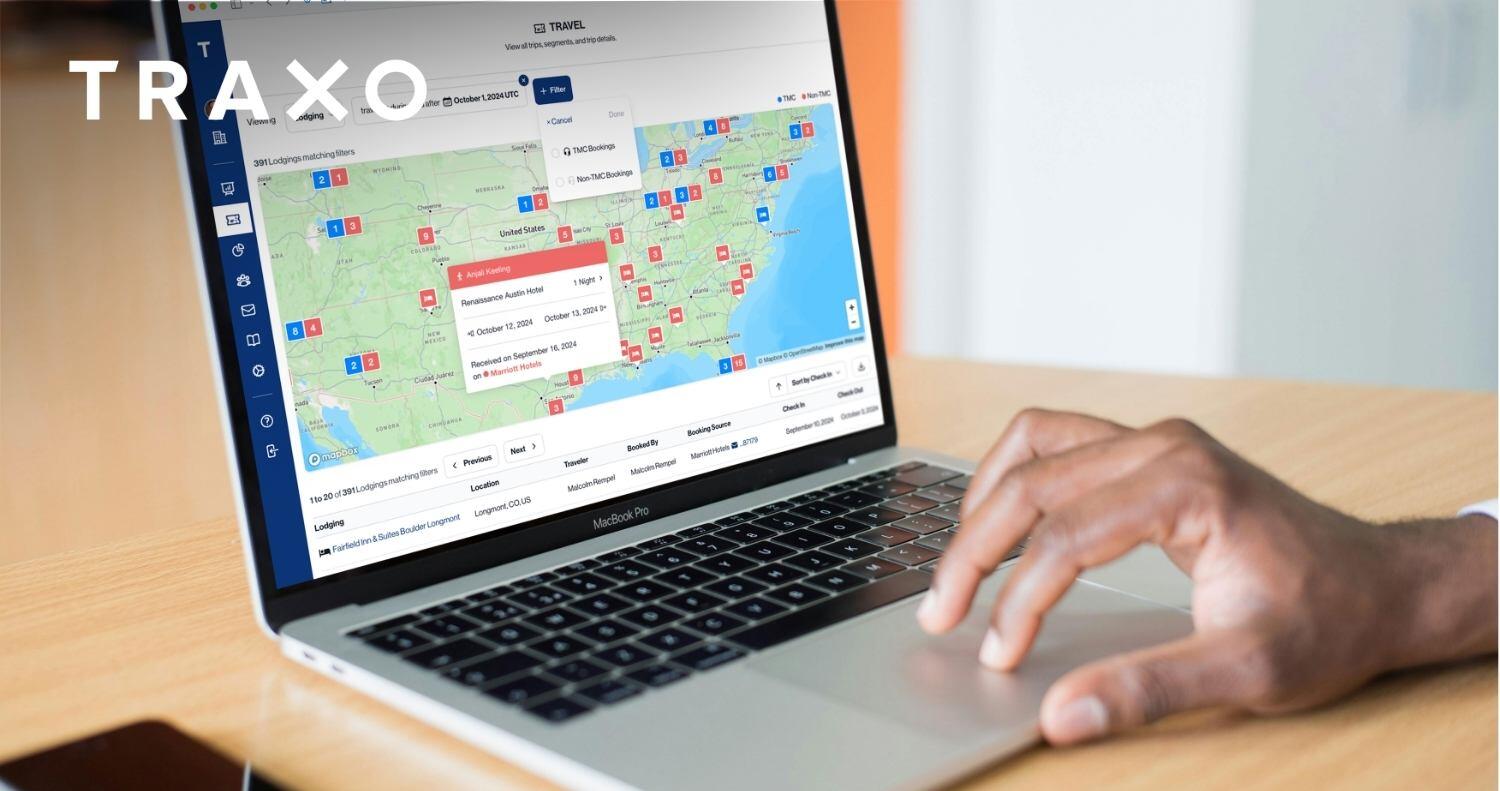

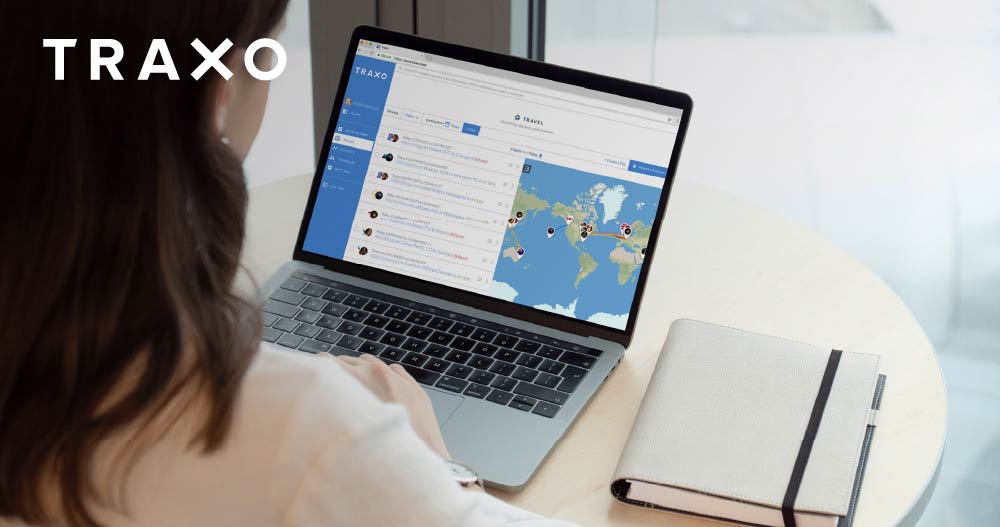

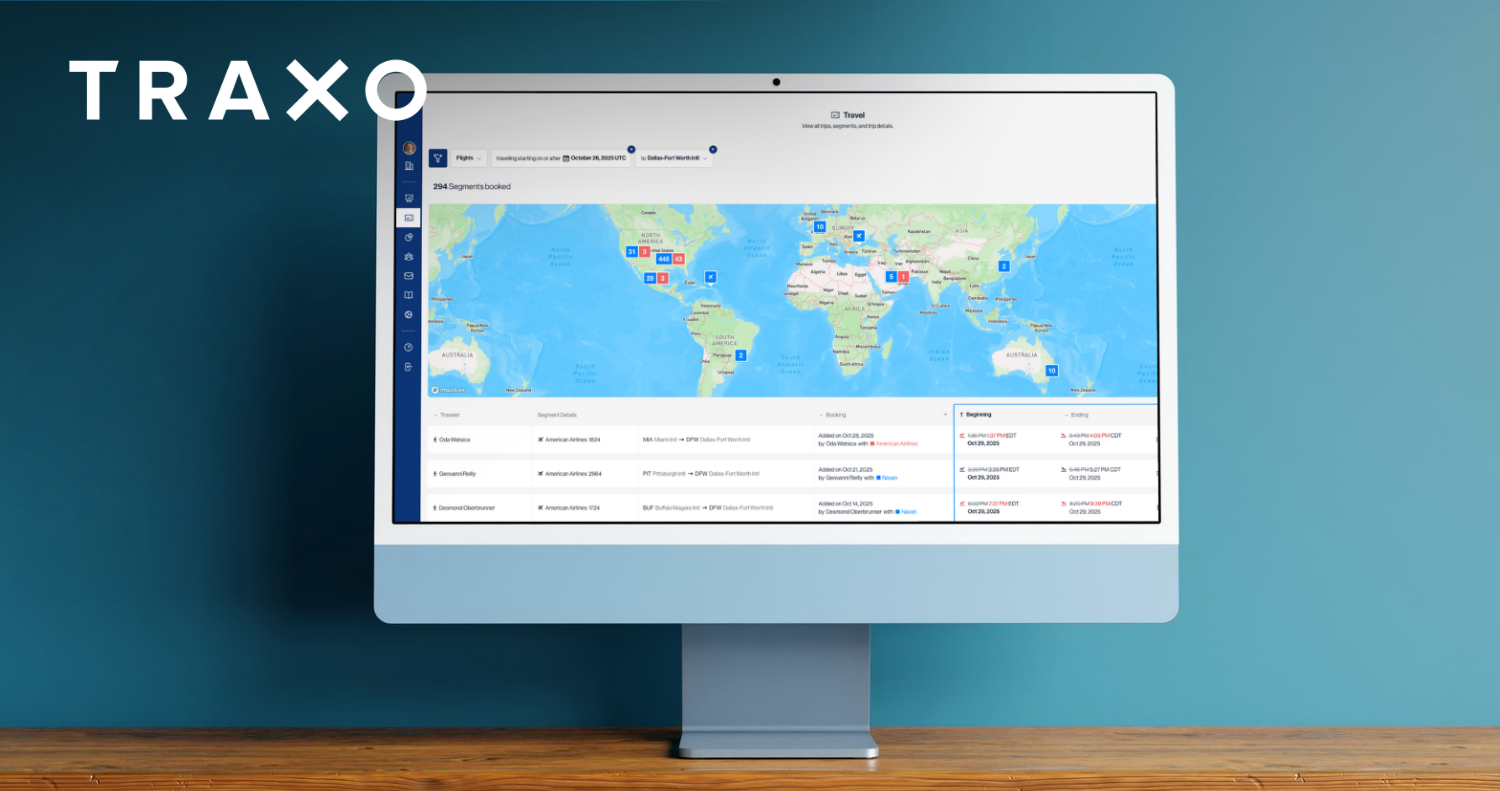

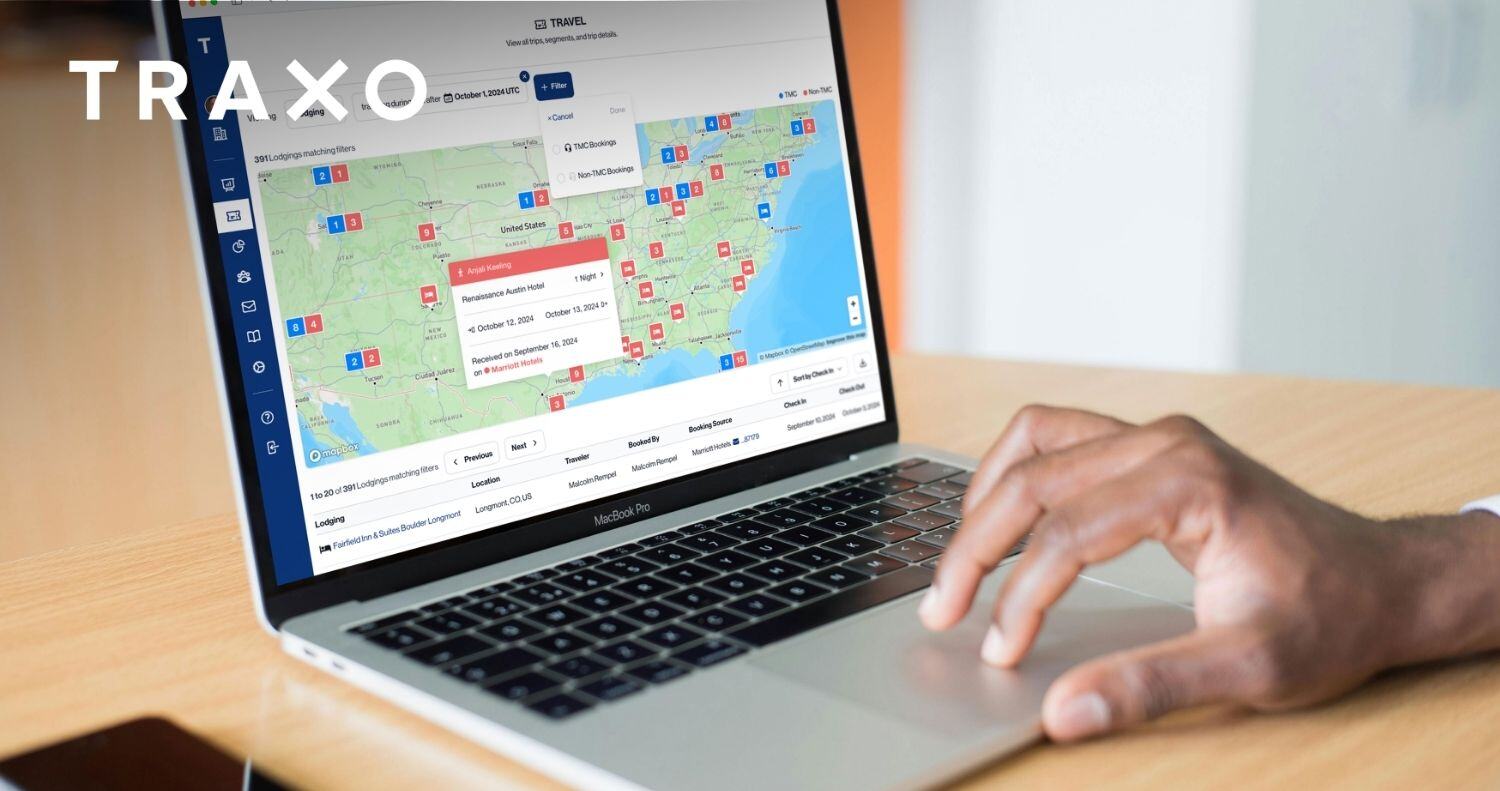

Traxo captures booking data from all sources — TMCs, OTAs, supplier-direct, even email confirmations — giving travel managers real-time visibility into all travel activity across the organization. This data can then be shared directly with travel risk management partners, like International SOS or Crisis24, to power more accurate traveler tracking, proactive alerts, and faster incident response.

With this kind of comprehensive data, organizations can confidently prove they’re meeting (or exceeding) ISO 31030 guidelines — and that opens the door to potential insurance savings.

Real-World Momentum for Risk-Based Discounts

The case for using TRM to secure lower premiums isn’t just theoretical. A recent study from International SOS, conducted in partnership with KPMG and Ipsos, revealed that more than half of HR professionals surveyed said their investment in TRM services helped them secure reduced premiums or coverage costs.

One case study involving Hiscox clients showed that organizations investing in proactive risk mitigation — including data-enabled TRM platforms — could qualify for a 10 to 20 percent allowance on premium spend.

Even though travel insurance margins are often thin, experts suggest that when TRM is considered as part of a broader business continuity strategy (e.g., integrating it with general liability or kidnap & ransom coverage), the financial benefits become much more significant.

How to Make Your TRM Program Count — and Pay Off

To position your organization for these benefits, you need to demonstrate more than just good intentions. You need:

- Real-time travel visibility: Capture all bookings, not just those through your TMC

- Proactive communication capabilities: Ensure risk alerts reach travelers

- Auditable compliance with ISO 31030: Align internal protocols with global standards

- Data-sharing with risk partners and insurers: Provide the proof needed for underwriting

With Traxo, your company is equipped to meet all four criteria.

Risk Management Isn’t Just the Right Thing to Do — It’s Smart Business

We’re entering a new era of business travel, where transparency and responsibility aren’t just compliance mandates — they’re financial levers. As insurers begin to recognize the risk-reducing power of well-managed travel programs, organizations that invest in complete data capture and ISO 31030 alignment will be first in line for savings.

Traxo makes it easy to unlock those benefits — and protect your people, your policy, and your bottom line.

Connect with Traxo

.png)