Corporate travel managers operate under a dangerous illusion. They believe they have visibility into their travel programs through agency reporting, expense reports, and credit card feeds. The reality? These traditional data sources create a fractured, delayed, and fundamentally incomplete picture that undermines every aspect of modern travel management, from duty of care to cost control.

The gap between perceived and actual visibility has never been more critical. As business travel rebounds amid increased complexity, distributed booking behaviors, and heightened safety concerns, organizations relying on antiquated tools and legacy travel visibility methods manage their programs through a rearview mirror, seeing only what happened weeks ago, with crucial details missing entirely.

The Fatal Flaws of Expense and Credit Card Data

The Timeline Problem: When "Real-Time" Means Weeks Later

Consider the typical lifecycle of travel data in most organizations. An employee books a flight for Tuesday, with travel the following week. The company won't see this booking in their systems until the expense report is filed, often 30 to 45 days after the trip concludes. By then, any opportunity for intervention has long passed. Policy violations can't be corrected. Safety risks can't be mitigated. Negotiated rates can't be enforced.

Credit card feeds promise faster visibility, but even Level-3 data typically arrives 24 to 72 hours after the transaction. And that's just the payment record, not the actual travel details. In an era where flight disruptions require immediate rebooking assistance and geopolitical events demand instant traveler location data, this delay isn't just inconvenient—it's operationally negligent.

The Fidelity Crisis: Financial Data Isn't Travel Data

Here's what expense reports and credit card statements actually tell you: someone spent $847 on "AIR TRAVEL - UNITED AIRLINES" on March 15th.

Here's what they don't tell you:

- Which flight was booked

- When will it depart and land

- Where was it purchased

- The fare class purchased versus your negotiated rates

- Whether it's a basic economy ticket that can't be changed

- The actual routing, including connection points and destination

- If the booking includes checked baggage or seat selection

- Whether the traveler opted for a red-eye that violates duty-of-care policies

- Any subsequent changes, cancellations, or rebookings

- Did the flight(s) depart and arrive on time or how late was it

- Metrics like the days in advance the purchase was made or the cost per mile

Financial datasets were designed for accounting reconciliation, not travel program management. They're the equivalent of trying to manage a supply chain using only invoice totals—you'd never know what products were ordered, when they'll arrive, if they meet specifications, or how well the vendor is meeting your needs.

The Personal Card Paradox

The most insidious gap in traditional visibility comes from a behavior pattern travel managers know but can't control: employees increasingly use personal credit cards for business travel. The motivation is simple—loyalty points, elite status qualification, and personal rewards that can be worth thousands of dollars annually to frequent travelers.

Airlines and hotels actively encourage this behavior. Many carriers make it difficult—or impossible—to store corporate cards for direct bookings, while offering bonus points and incentives for using personal cards on their websites. They introduce friction into corporate payment workflows while streamlining personal transactions. The result is a growing visibility gap: according to Hotel Tech Report, one in three business travelers still books work travel using personal credit cards, pushing a substantial share of spend outside managed programs and into blind spots for travel managers.

A Day in the Life of Visibility Failure

Let's follow Sarah, a sales executive, through a typical booking scenario that illustrates how quickly control evaporates:

Monday, 9 AM: Sarah receives notice of a critical client meeting in London next week. Your company has negotiated rates with three carriers and a preferred business class policy for transatlantic flights over six hours.

Monday, 11 AM: Sarah books directly on her favorite airline's website—not one of your preferred carriers—because she needs 500 more miles for elite status. She uses her personal card to maximize points earnings. She chooses premium economy over business class to save money and appease the finance department.

Monday through Thursday: Your travel management team has no idea Sarah is traveling internationally. Your security team doesn't know to monitor London risk assessments. Your procurement team can't track spend against negotiated agreements or on-time performance against operational reliability goals.

Wednesday (travel day): Sarah's flight is cancelled due to weather. She rebooks herself on a different carrier, in economy, with two connections through cities not covered by your duty-of-care protocols. You still don't know she's traveling.

Three weeks later: An expense report appears showing $3,400 in air travel. No details. No ability to verify policy compliance. No opportunity to help during the disruption. Diminished intelligence to support your next career negotiation or opportunity to use this travel in program objectives analysis. Just a number in a spreadsheet, weeks after the fact.

The "We Already Have Visibility" Delusion

The market has responded to these challenges by proliferating tools that claim to solve the visibility problem. Travel managers hear pitches about credit card integrations, supplier APIs, and expense management platforms and travel agency solutions with "enhanced travel modules." The industry press celebrates these as breakthrough solutions. They're not.

Why Legacy Visibility Tools Fall Short

- Limited Breadth: Most visibility tools capture travel details from a narrow set of sources. TripLink covers only participating suppliers in the Concur ecosystem. Travel agency solutions only cover what they sell. Credit card integrations only work when corporate cards are used. Each solution captures perhaps 20-30% of your program, leaving massive gaps that compound into systematic blindness.

- Shallow Depth: Even when these tools capture bookings, they rarely acquire the operational details that matter. Level-3 credit card data might tell you someone flew from New York to London, but not whether they took the recommended 9 AM departure or the red-eye that leaves them exhausted for client meetings. You'll see a hotel charge, but you won't know whether they booked the standard room at your negotiated rate or upgraded to a suite at rack rates.

- Persistent Delays: "Real-time" in most visibility tools means "within 24-48 hours if everything processes correctly." By the time data flows from the supplier to the aggregator to the normalization engine to your reporting dashboard, the moment for intervention has passed. You're not managing travel; you're conducting a retrospective.

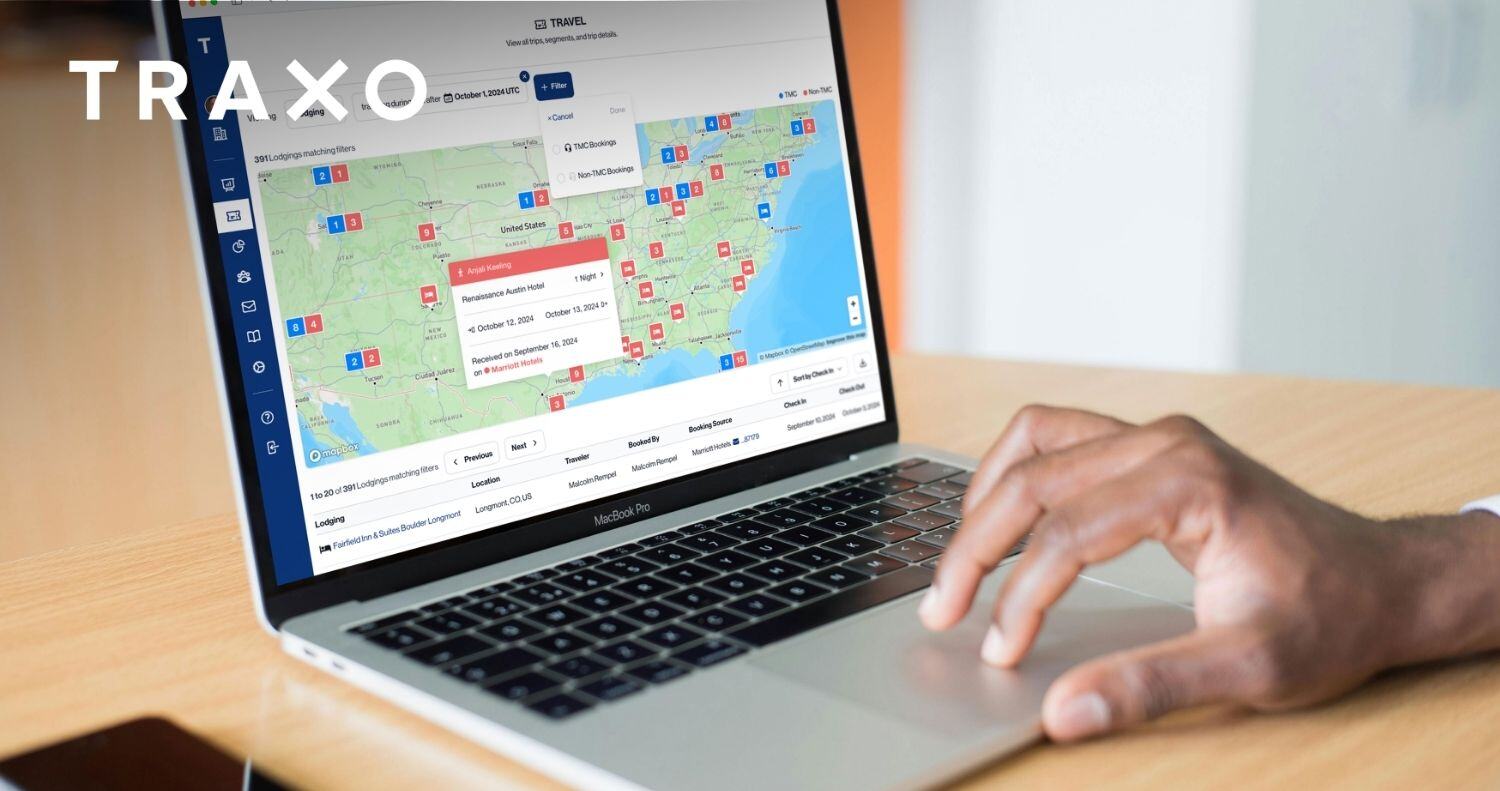

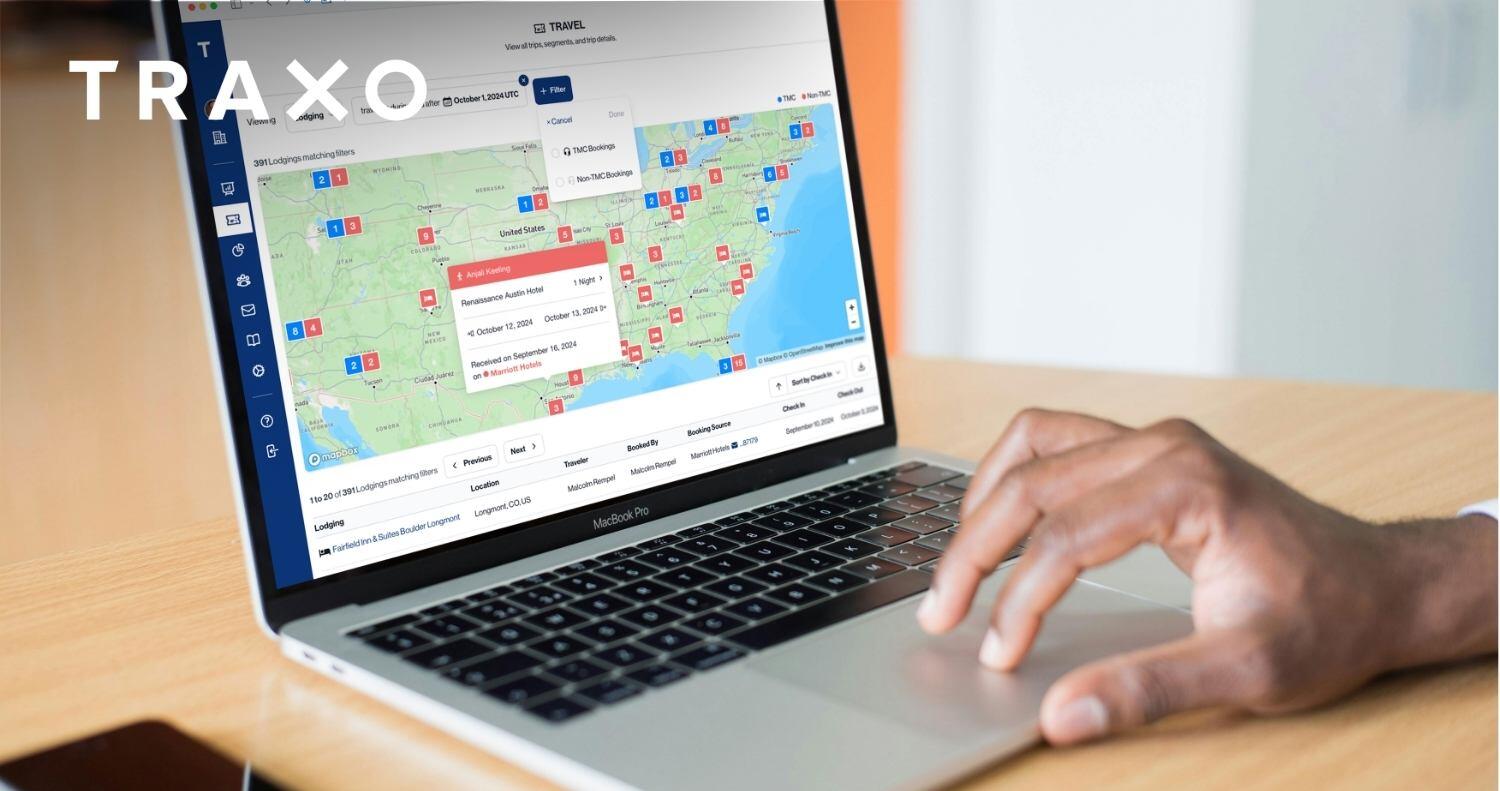

The Modern Solution: Automatic, Comprehensive, Immediate

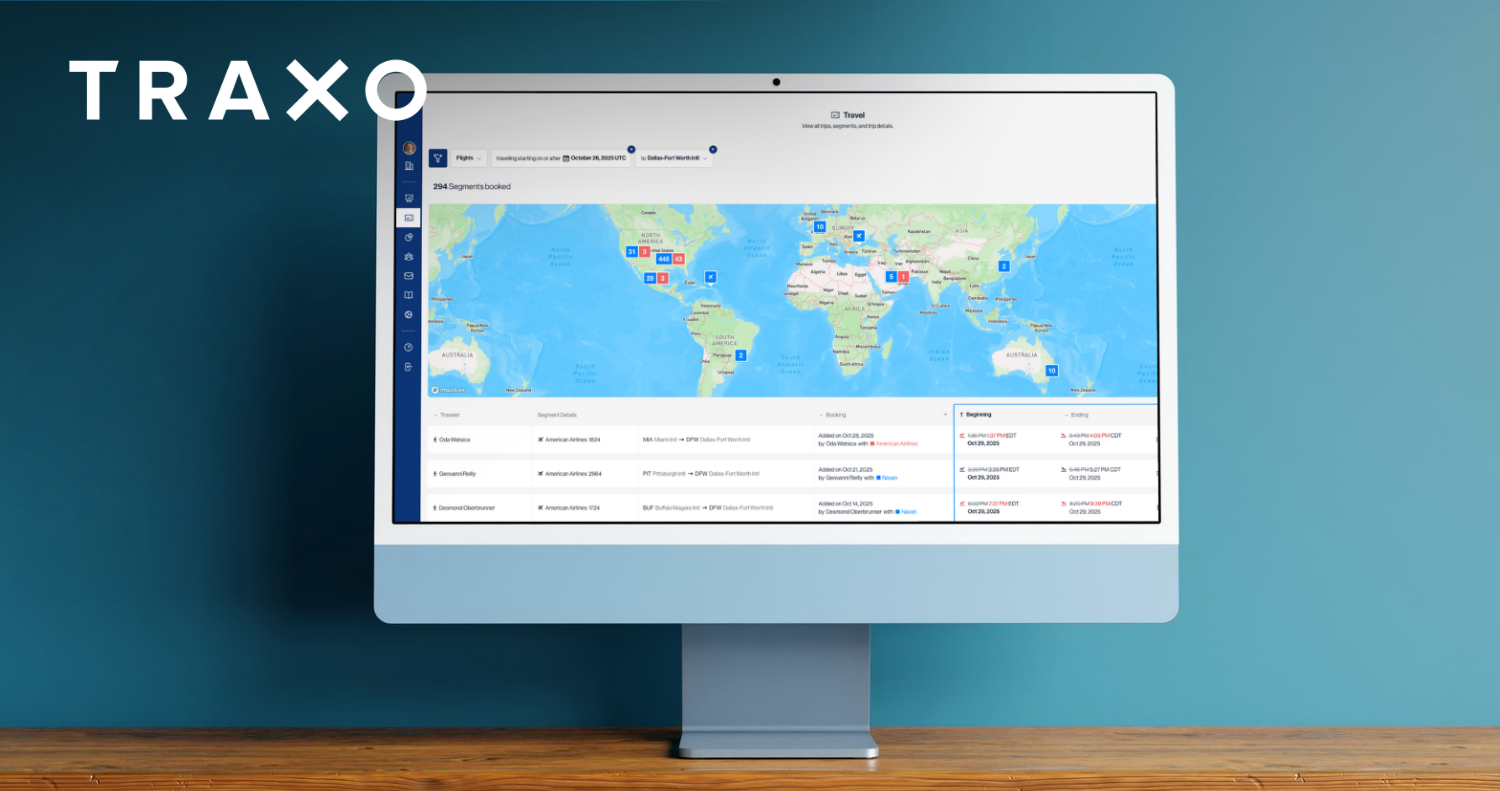

The path forward requires fundamentally reimagining how travel data is acquired. Instead of waiting for financial transactions to flow through corporate systems, a modern travel management tool captures booking data at the source, the moment a reservation is made, regardless of payment method or booking channel.

This is where features like Traxo's AutoDetect represent a paradigm shift in travel management software. By automatically detecting bookings across hundreds of suppliers through tighter integrations, these platforms capture the complete booking record—every segment, every fare rule, every ancillary—in real-time. No dependency on traveler behavior. No waiting for expense reports. No gaps from personal card usage.

The implications cascade through every aspect of travel management:

- Duty of Care: Know where travelers are before they depart, not after they return

- Cost Control: Identify out-of-policy bookings while they can still be changed

- Supplier Management: Negotiate with complete data on actual purchasing patterns

- Traveler Support: Provide proactive assistance during disruptions

- Compliance: Ensure regulatory requirements are met before travel occurs

Myth versus Reality: Understanding True Visibility

|

The Myth |

The Reality |

|

"Credit card feeds give us booking visibility" |

Payment records lack operational details and arrive too late for intervention |

|

"Expense reports capture all travel spend" |

Bookings on personal cards never appear until reimbursement |

|

"Our TMC’s solution shows us everything" |

Average corporate bookings exceed 40% outside managed channels |

|

"Supplier APIs provide real-time data" |

Limited to participating suppliers and often exclude critical booking details |

|

"We can mandate corporate card usage" |

Traveler rewards, incentives and supplier limitations make this unenforceable and unrealistic |

The Price of Incomplete Visibility

Organizations operating with traditional visibility methods aren't just missing travel—they're missing opportunities. Every invisible booking represents:

- Unutilized negotiated rates that weaken future negotiations

- Unmanaged risk that could escalate into duty-of-care failures

- Unidentified savings that compound into millions in preventable costs

- Untracked patterns that could optimize supplier strategies

- Unsupported travelers who remember when they needed help and didn't receive it

Building a Modern Travel Data Architecture

The solution isn't adding more band-aids to a broken system. It's implementing data acquisition that works the way modern business works—automatic, comprehensive, and immediate. True visibility means:

- Automatic detection that doesn't depend on traveler compliance or payment methods.

- Complete reservation details that mirror what exists in airline and hotel systems

- Real-time acquisition that enables intervention before travel occurs

- Unified normalization that makes data immediately actionable for analysis and response

This is about recognizing that expense reports and credit card feeds were never designed to manage travel. They're archaeological records of what happened, not operational data for what's happening.

The Competitive Imperative

As organizations compete for talent, optimize costs, and manage increasingly complex risk landscapes, travel program visibility has evolved from an operational nice-to-have to a strategic imperative. Companies using a solution that provides true visibility can promise employees they'll never be stranded without support. They can guarantee that negotiated agreements are being utilized. They can assure boards that duty-of-care obligations are being met.

Those relying on expense reports and credit card feeds can promise none of these things. They're managing in the dark, hoping that what they can't see won't hurt them. In modern corporate travel, what you can't see isn't just hurting you—it's defining the limits of what your program can achieve.

The question isn't whether you need better visibility. It's whether you'll achieve it before the hidden crisis in your travel program becomes a visible failure that was entirely preventable.

Take Control of Your Travel Program Today

The gap between what you think you see and what's actually happening in your travel program grows wider every day. Discover how the Traxo platform can illuminate every corner of your travel program by automatically capturing bookings across all suppliers, payment methods, and booking channels in real time and making it available as part of a complete travel management solution for intelligence and insights.

Connect with Traxo

.png)